💸 Swiggy's IPO Plans

In today's edition of our newsletter at Airtribe, we are delving into Swiggy's IPO plans and how to become a PM if you're an engineer.

Swiggy, a leader in India's food and grocery delivery sector, is undergoing a significant transformation. As it prepares for an IPO, the company is not only diversifying its revenue streams with advertising and Instamart but also making tough decisions for long-term sustainability. Facing investor pressure to exhibit profitability before their IPO, they unfortunately had to lay off 400 employees.

Instamart: A New Leader in Swiggy's Portfolio

Swiggy's Instamart, the quick-commerce arm, is rapidly emerging as a major vertical, potentially surpassing the core food delivery business. Group CEO Sriharsha Majety, in his remarks at the World Economic Forum in Davos, emphasized Instamart's growing significance. With its contribution to Swiggy's overall revenue increasing, Instamart is not just a supplementary service but a central growth driver for the company. The shift in consumer preference towards convenient grocery and allied item deliveries, as opposed to traditional restaurant food deliveries, is a clear indicator of Instamart's potential to achieve greater market penetration.

Financial Milestones and Market Share

In the fiscal year 2022, Instamart made a significant impact with a revenue contribution of Rs 2,036 crore, holding a substantial 32% market share. This impressive performance underscores the strategic importance of Instamart in Swiggy's business model. The company is now focused on making Instamart profitable by March this year, despite currently incurring a burn rate of 20 million a month, as reported by TechCrunch.

Advertising Revenue: A Robust Growth Trajectory Swiggy's foray into the advertising sector has been marked by a strong performance, with the company currently at an annualized run rate of Rs 1,000 crore in advertising revenue. This figure is expected to double to Rs 2,000 crore in the next year, reflecting the company's aggressive growth strategy in this domain. Swiggy's unique advertising inventory, including innovative placements and formats, is attracting significant interest from major brands, further bolstering its revenue prospects.

Customer Retention and Loyalty Initiatives

In a bid to enhance customer retention and loyalty, Swiggy had launched 'Swiggy One' and a co-branded credit card with HDFC. These initiatives are designed to offer added value to customers, fostering a sense of loyalty and increasing the frequency of orders. According to a recent report by ET, HDFC has issued around 1.2 Lakh cards to Swiggy users.

Strategic Divestment: Selling Cloud Kitchen Business

In a strategic move, Swiggy sold its cloud kitchen business to Loyal Hospitality, which operates under the brand Kitchens@. This decision, part of broader cost-cutting measures, reflects Swiggy's focus on core competencies and profitability.

The Road Ahead

As Swiggy navigates these strategic shifts, the focus remains on building a robust, diversified business model. The company's efforts in advertising, quick-commerce, customer loyalty programs, and strategic divestments are all geared towards creating a sustainable and profitable future. Time will tell how well Swiggy fares in this endeavor.

From Engineer to Product Manager at Ola

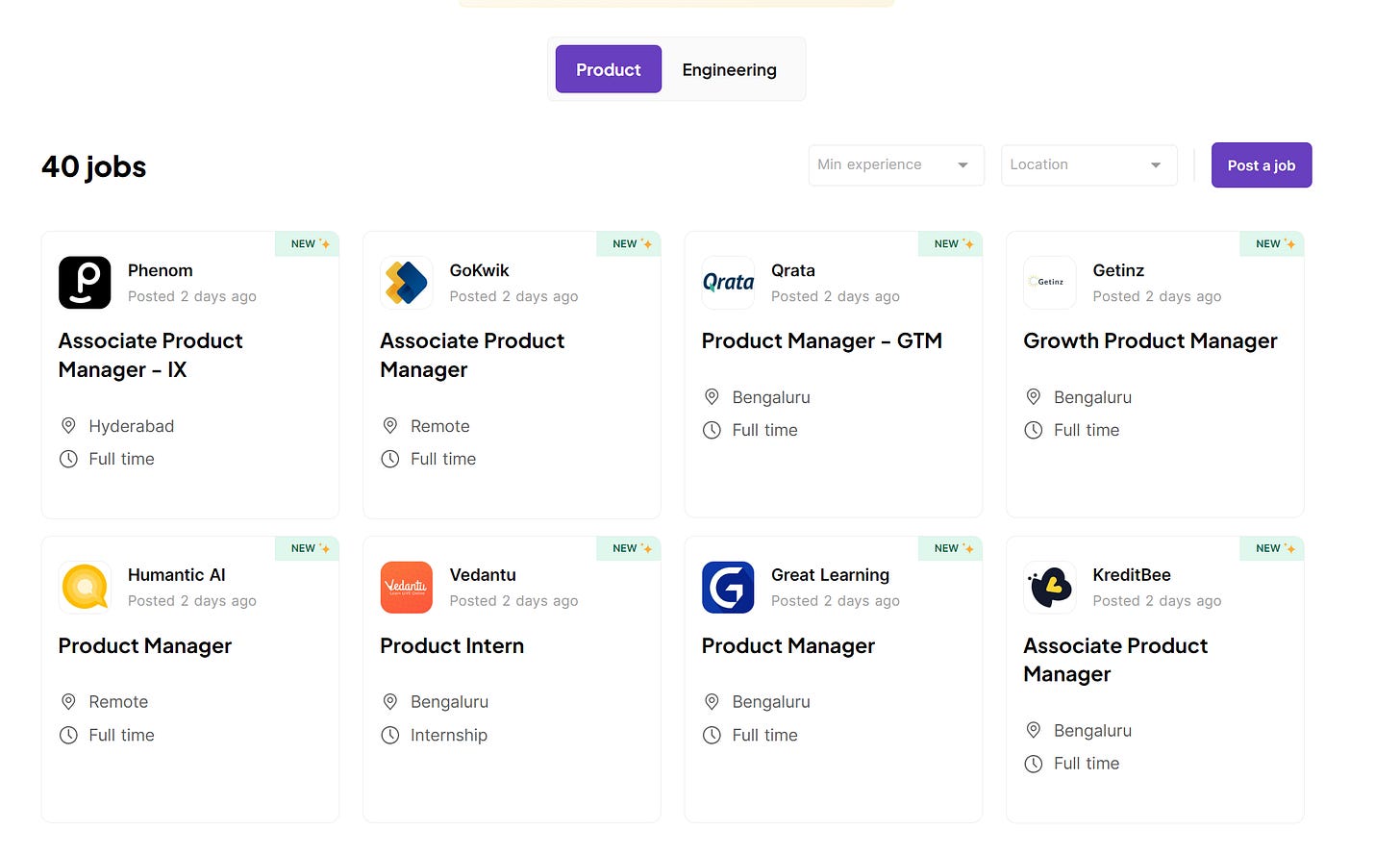

Job Board

That’s all for today, folks! Hope you enjoyed this week’s newsletter. We’ll see you next week. 🤗

Until then, keep learning and growing! 👋